How COVID-19 is impacting industrial workforce turnover and what companies can do to improve from here

May 23, 2020

At WorkStep, we build technology and tools that help large industrial employers make better hires and build long-term retention within their hourly workforce. This technology platform creates a unique visibility into the success (or failure) of tens of thousands of hires annually.

Over the past two months, we’ve leveraged that insight to analyze how COVID-19 has impacted why industrial workers are leaving their jobs, how frequently they’re leaving, and what companies can do invest in employee retention now.

Reasons behind industrial turnover (Pre-COVID)

From when we founded WorkStep in 2017 until Mid-March 2020, we operated in a historically-low unemployment environment. Unsurprisingly, in a fast-growing sector of the economy where unemployment frequently dipped below 3%, during that period we saw that the vast majority of industrial turnover was a result of a worker-side decision.

Voluntary vs. involuntary turnover (Pre-COVID)

Digging further into Involuntary reasons for leaving, we saw that 45% of this bucket was a result of attendance.

Segmenting involuntary reasons for leaving (pre-COVID)

Combining these segments, in the pre-COVID world, over 80% of all industrial terminations were a result of the employee choosing to leave, either by quitting or stopping attending work (69% Voluntary turnover + 14% Attendance, which represents 44.9%% of all Involuntary turnover). Losing 4 out of 5 workers for reasons seemingly out of your control was, of course, incredibly frustrating for industrial employers of all sizes.

Reasons behind industrial turnover (post-COVID)

From mid-March to where we are today (mid-May 2020), the national unemployment rate has grown by over 4 times, from 3.5% to 15%, with all signals pointing to it trending even higher. While some industrial companies have been slowed down by the pandemic, many others (ex: eCommerce & grocery distribution) have grown as a result.

Perhaps surprisingly, even in a weakened economy where a worker’s next job might be harder to come by, voluntary turnover still represents the lion’s share of job separations, though involuntary has increased from 31% to 38% of all separation events.

Voluntary vs. involuntary turnover (post-COVID)

Digging further into ‘Involuntary’ reasons for leaving, we see that layoffs have grown from 15% to 40% of this bucket, which is logical given the sudden demand stoppage in some industries (ex: food service distribution). Meanwhile, attendance as the underlying reason has been cut by more than half, now representing the reason behind only 21% of involuntary separations.

Segmenting involuntary reasons for leaving (post-COVID)

Combining these two views, just under 70% of all industrial terminations are, today, a result of the employee choosing to leave, either by quitting or stopping attending work (61.8% Voluntary turnover + 8% Attendance reason, which represents 21.1% of all Involuntary turnover). This is down from over 80% in the pre-COVID era. Layoffs now account for 15% of all industrial separations, combining voluntary and involuntary, which is up from 5% in the years preceding COVID.

Impact on overall turnover rates

The good news, if there is any in this situation, is that we’re seeing a lift in overall retention. On average, our data shows a 14% increase in average tenure post-COVID. This increase is primarily being driving by a 61% drop in employees reporting that they left a role because they found a better job.

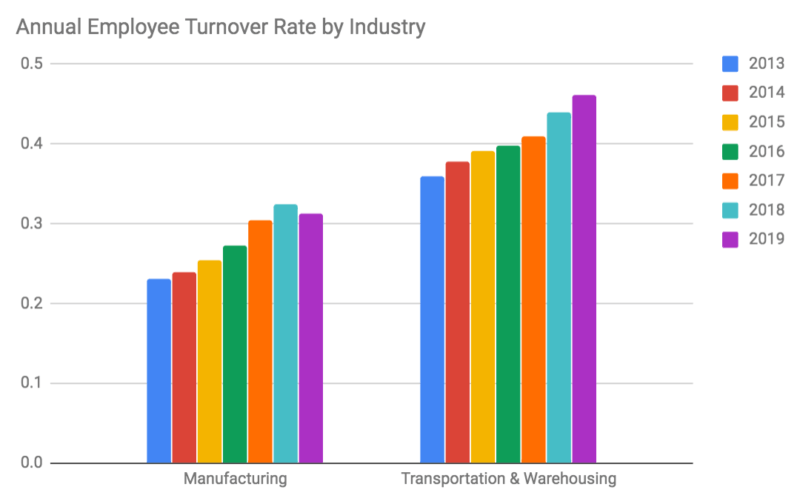

While not massive (yet), this trend will be a welcome change of pace for an industry that has seen average turnover rates increase every year for the last 6 years.

How to improve from here

Even with a nominal retention increase as a result of COVID-19, there is still plenty of room for retention improvement at industrial companies, given that 7 out of 10 turnover events are still being instigated by the employee. Whether an essential or non-essential business, the organizations most successful in addressing the turnover challenge are doing the same two things:

1) Capture and regularly report on the inputs that matter

To fix a leaky bucket, you need to know where the leak is.The most successful companies are able to, first, drill in to understand turnover rates by time employed, shift, facility, manager, and so on. Secondly, they’re able to regularly collect workforce feedback and tie that to turnvoer to understand the leading indicators of a turnover event.

2) Invest in those areas that can have the greatest impact on turnover

If the overall turnover numbers are being dragged down by night shift drivers in their first 30 days employed in the West region, that’s the right place to start focusing. Similarly, on the sentiment side, if employees with a poor relationship with their manager are 2X more likely to leave the company in the next 90 days, investing in those relationships would have major upside. Taking on step 1, with a technology platform like WorkStep, enables the possibility of these high-leverage investments.

While average tenure has increased and retention reasons have shifted slightly from voluntary to involuntary, even in a post-COVID world, industrial retention still represents a massive, strategic opportunity for companies that rely on a large industrial workforce. At WorkStep, we’re here to help.

Dan Johnston, Co-Founder & CEO | dan@workstep.com